U.S. Auto Insurance Policy Shopping and New Business Growth Continue to Break Records in Q4 with "Hot " Readings on the LexisNexis® U.S. Insurance Demand Meter

U.S. Auto Insurance Policy Shopping and New Business Growth Continue to Break Records in Q4 with "Hot" Readings on the LexisNexis® U.S. Insurance Demand Meter |

| [18-February-2026] |

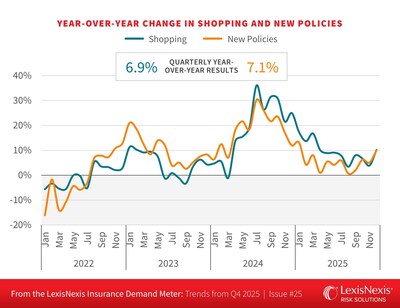

ATLANTA, Feb. 18, 2026 /PRNewswire/ -- Shopping for U.S. auto insurance remained in high gear through the fourth quarter of 2025, according to the latest U.S. Insurance Demand Meter from LexisNexis® Risk Solutions. The quarterly year-over-year shopping growth registered "Hot", rising to 6.9% on the Demand Meter, while new policy growth also clenched a "Hot" reading, increasing to 7.1%. Key Takeaways

Long-Tenured Policy Holders, Standard Shoppers and Direct Channel Help Propel Growth Consumers aged 66 and older, standard shoppers and the direct channel continued to lead Q4 2025 U.S. auto policy shopping with the highest growth rates; however, the exclusive agent channel saw notable growth, too. Shoppers 66 and older were the most active, achieving a quarterly year-over-year growth rate of 11%. This group has consistently outpaced younger demographics in terms of shopping growth since Q1 2023. Additionally, shopping activity through the direct channel grew 12.6%, which represents a slight cooling from last quarter's 14.1% growth. Additionally, for the first time in 2025, the exclusive channel posted a positive growth rate, 5.3%, likely tied to increased ad spending from exclusive channel carriers. However, the independent channel continued experiencing a downward growth trajectory, dipping to -0.1%, the first negative growth rate since Q1 2024. Many of these dynamics helped drive the annual shop rate to a new all-time high since the inception of the LexisNexis U.S. Insurance Demand Meter. As of Q4 2025, 47.1% of policies-in-force had been shopped at least once in the past 12 months, a 1.9-point increase from Q4 2024 and a 5.9-point increase from Q4 2023. The Majority of Rate Filings were Decreases In Q4, 25% of rate revisions were increases, with an average increase of +5.1%. Another 25% were rate-neutral filings, and 50% of rate modifications were decreases. This translated to an overall industry rate impact of -0.5%.1 These changes somewhat mirrored the Top 25 auto carrier rate activity, among which 41% of rate revisions were decreases, 35% were increases and 23% were rate-neutral. Among this group of insurance carriers, the overall rate impact was -0.7%.2 Together, these declining rate trends helped contribute to increased consumer shopping activity as drivers sought more favorable pricing conditions "2025 reminded us that we're operating outside of a traditional insurance cycle. Even as the market shifts from steep rate increases to broad-based decreases, shopping and new business remain elevated," said Jeff Batiste, senior vice president and general manager, U.S. auto and home insurance, LexisNexis Risk Solutions. "In this environment, cutting rates without precision can turn today's growth into tomorrow's volatility — especially among longer-tenured customers. Insurers that keep segmentation and discipline at the center of their strategies and enact growth with guardrails should be well positioned for whatever 2026 brings." Examining Repeat Shoppers A LexisNexis Risk Solutions internal study examined a subset of consumers for deeper analysis, policyholders who had not shopped their policies from July 2023 to June 2024, and broke them up into two groups: those who shopped in July of 2024 – Once-Sidelined Shoppers – and those who continued to refrain from shopping– the Waited, not Baited cohort. As reported in last quarter's edition, we found that when Once-Sidelined Shoppers shopped, they were then twice as likely to shop again, particularly within the next six months, compared to the Waited, not Baited group. In this edition, we dug more deeply into insights related to the age and tenure of these shoppers. When it came to age, the largest demographic within the Once-Sidelined Shopper group is the 66 and older cohort, accounting for 22% of that population, compared to their representation of 16% in the total shopping population. This age group has been growing at an accelerated rate since 2024, indicating that once older shoppers are shopping, they're realizing the benefits and shopping again. When comparing the tenure of the Once-Sidelined Shoppers to all shoppers, those with more than 10 years of tenure comprised 29% of the Once-Sidelined Shoppers group, compared to the 19% they accounted for among the overall shopping population. Longer tenured customers who were previously loyal to their insurers are now seeking better rates and are willing to shop more frequently. Looking Ahead Rate increases, wallet-conscious consumers and marketing programs that helped drive U.S. auto policy shopping and new business volumes broke record levels and made the final quarter more active than usual. The industry should be watching to see if the new wave of rate adjustments seen in Q4 exercise any impact on consumers' urge to shop or if recent shopping behavior has encouraged more frequent shopping. Download the latest U.S. Insurance Demand Meter. LexisNexis U.S. Insurance Demand Meter About LexisNexis Risk Solutions Media Contacts: 1 S&P Global Market Intelligence (and its affiliates, as applicable), January 2, 2026

SOURCE LexisNexis Risk Solutions | ||

Company Codes: LSE:REL,NYSE:RELX |