Dye & Durham Reports Preliminary Unaudited Fiscal 2025 and Q1 Fiscal 2026 Results and Provides Updated Business Outlook

Dye & Durham Reports Preliminary Unaudited Fiscal 2025 and Q1 Fiscal 2026 Results and Provides Updated Business Outlook |

| [12-November-2025] |

TORONTO, Nov. 12, 2025 /CNW/ - Dye & Durham Limited (the "Company" or "Dye & Durham") (TSX: DND) today announced preliminary unaudited results for the fiscal year ended June 30, 2025 ("FY 2025") and the first quarter of fiscal 2026 ("FY 2026"), together with an updated business outlook reflecting early progress under new leadership. All financial references are in Canadian dollars unless otherwise noted. Additionally, the Company provided its regular bi-weekly default status report in accordance with National Policy 12-203 – Management Cease Trade Orders ("NP 12-203"), along with an update on the timing of its 2025 Annual General and Special Meeting of Shareholders (the "2025 AGM"), and reported on certain related matters. Key Highlights

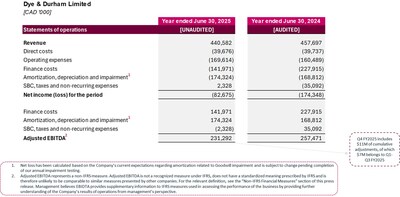

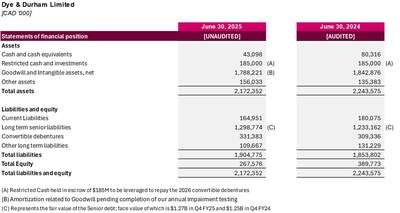

Preview of Unaudited FY 2025 and First Quarter FY 2026 Results To provide investors with greater visibility into the Company's performance while it continues to finalize the filing of its audited financial statements and complete the previously disclosed review being undertaken by the Ontario Securities Commission (the "OSC"), the Company is releasing a preview of its unaudited financial results for the FY 2025, and for the first quarter of FY 2026 ended September 30, 2025. For the full FY 2025, management anticipates unaudited financial results as follows:

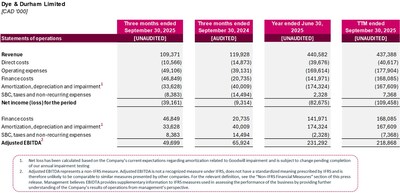

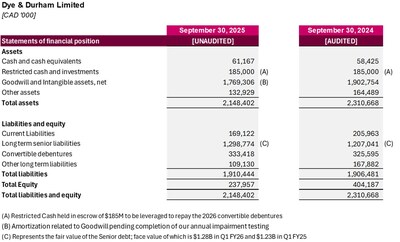

The fourth quarter Adjusted EBITDA included cumulative adjustments totalling approximately $11 million, of which about $7 million was related to prior quarters. These adjustments reduced Adjusted EBITDA for the fourth quarter of FY 2025. Excluding these prior-period adjustments, unaudited Adjusted EBITDA for the quarter was approximately $50.3 million. For the first quarter of FY 2026, management anticipates the unaudited financial results as follows:

Based on the unaudited results noted above, the Company expects to be in compliance with the financial covenants under its senior credit agreement with respect to the fiscal quarters ended June 30, 2025, and September 30, 2025. These figures remain subject to final review by management, the Audit Committee, and the Board of Directors (the "Board"), as well as completion of the Company's standard closing and audit procedures for FY 2025 and review procedures for the first quarter of FY 2026. The unaudited figures are not a substitute for audited financial statements prepared in accordance with IFRS, and while final audited results may differ as the OSC Review and audit are completed, they are not expected to differ materially from the information presented herein. Updated Outlook Following the appointment of George Tsivin as Chief Executive Officer at the beginning of June 2025, the Company took immediate and decisive action to strengthen its operational and financial foundation. One of Mr. Tsivin's first initiatives was to launch a transformation program to drive cost savings across the business and create reinvestment capacity. The program is underway and being executed over the next two years through initiatives focused on improving operational efficiency, implementing automation, optimizing workflows, and aligning resources to support sustainable growth. The program is expected to deliver annualized run-rate savings of approximately $15-20 million by the end of FY 2027, with about 60% anticipated in FY 2026 and the remainder in FY 2027. While underway, these initiatives have not had a substantial impact on Q1 FY 2026 results. Alongside this focus on operational efficiency, the Company is executing a broader transformation strategy centered on the customer-first strategic plan that was announced by the Board concurrent with third quarter FY 2025 results. Product innovation is at the heart of Dye & Durham's customer-first strategy. Under the leadership of Chief Product Officer Nikesh Patel, the Company has initiated a comprehensive product rationalization program that will simplify offerings into three core platforms: (i) general practice management, (ii) vertical practice applications, and (iii) law data, search and file. This initiative is improving the customer experience, streamlining operations and enabling deeper integration across cloud-based technologies. Progress has been made, with plans to consolidate more than 40 SKUs into approximately 10 or fewer global products. The Company is also migrating to modern, multi-tenant cloud platforms in partnership with leading technology providers, using a cost-effective hybrid delivery model that maximizes return on investment. Commercial excellence initiatives are also underway and are reinforcing the Company's commitment to customer-first growth. Dye & Durham is realigning its commercial strategy to ensure pricing reflects value delivered, modernized products meet and exceed customer expectations, and integration across platforms creates new opportunities for cross-sell and customer acquisition in key markets. These actions are designed to grow market share, enhance margins, and deliver improved value to customers. Financial discipline is central to the Company's overall strategy. Under the leadership of Interim Chief Financial Officer Sandra Bell, Dye & Durham continues to prioritize disciplined capital allocation, balance sheet optimization, and transparent financial reporting. Ms. Bell brings extensive experience in corporate turnarounds and financial governance, which has been instrumental in advancing the Company's renewed focus on prudent capital management. As part of this focus, in the first quarter of FY 2026, the Company announced the sale of Credas for gross proceeds of $146.0 million. This transaction represents a significant milestone in strengthening the balance sheet and improving financial flexibility. The sale is expected to reduce the Consolidated First Lien Net Leverage Ratio (as defined in the senior credit agreement) by approximately 0.5x and enhance free cash flow on a net basis after accounting for the associated profit reduction. Upon closing, anticipated by January 2026, the Company expects to apply approximately $30 million of the proceeds to reduce its revolving credit balance, with the remainder used to pay down first lien indebtedness in accordance with its debt agreements. These actions demonstrate the Company's commitment to balance sheet discipline and will provide additional liquidity and covenant headroom as it advances its operational turnaround. FY 2026 is an investment year focused on executing the transformation strategy, with the business expected to stabilize in the second half of FY 2026 and return to growth in early FY 2027. "I am incredibly proud of what our team has accomplished in just over four months," said Chief Executive Officer, George Tsivin. "We have taken immediate steps to strengthen our operations, align our organization with our customers, and position the business for long-term success. While there is still much work ahead, I am confident that our customer-first strategy, supported by an outstanding leadership team, will drive meaningful progress in FY 2026 and beyond. I want to thank our employees for their commitment and our customers for their continued trust and partnership." MCTO Status Update On October 1, 2025, the Company announced that, at the request of the Company, the OSC issued a temporary and voluntary management cease trade order (the "MCTO") against the Company under NP 12-203 in connection with the Company's delayed filing of its: (i) audited consolidated financial statements for FY 2025 (the "Annual Financial Statements"), (ii) management's discussion and analysis relating to the Annual Financial Statements, and (iii) CEO and CFO certificates relating to the Annual Financial Statements (collectively, the "Annual Filings"). The Company announced today that it expects to also be delayed in filing its (i) unaudited consolidated financial statements for the first quarter of FY 2026 (the "Q1 Financial Statements"), (ii) management's discussion and analysis relating to the Q1 Financial Statements, and (iii) CEO and CFO certificates relating to the Q1 Financial Statements (collectively, the "Q1 Filings", and together with the Annual Filings, the "Required Filings"). The Annual Filings were required to be filed by September 29, 2025, and the Q1 Filings are required to be filed by November 14, 2025. The delay in filing the Required Filings relates to the OSC Review, which the Company is currently working to complete. Once the OSC Review is completed, the Company will finalize and file the Required Filings as quickly as possible. The MCTO prohibits the Company's Chief Executive Officer and Chief Financial Officer from trading in and acquisitions of, whether directly or indirectly, securities of the Company until two full business days following receipt by the OSC of the Required Filings. The MCTO does not restrict or affect the ability of other shareholders or investors to trade in the Company's securities. Pursuant to NP 12-203, Dye & Durham must file bi-weekly default status reports by way of news releases during the period of the MCTO. The Company previously filed a bi-weekly default status report by way of news release on October 29, 2025. Other than as disclosed herein, the Company confirms that since October 29, 2025: (i) there has been no material change to the information contained in the press release issued by the Company announcing the issuance of the MCTO; (ii) there has been no failure to fulfill its stated intentions with respect to satisfying the provisions of the alternative information guidelines set out in NP 12-203; (iii) there has not been any other specified default subsequent by the Company under NP 12-203; and (iv) there is no other material information concerning the affairs of the Company that has not been generally disclosed. Until the filing of the Required Filings and during the period of the MCTO, the Company will follow the provisions of the alternative information guidelines as required by NP 12-203. Extension of MCTO To provide the Company with additional time to complete the OSC Review, and finalize and file the Required Filings, the Company announced today that it is applying to the OSC to extend the MCTO. The initial granting of the MCTO ends on November 29, 2025. If the extension of the MCTO is granted, until the filing of the Required Filings and during the extended period of the MCTO, the Company will continue to follow the provisions of the alternative information guidelines as required by NP 12-203. The Company will also issue an update once the OSC has responded to the extension request. If the MCTO is not granted, and the Company is not able to file the Required Filings by the 60th day from the initial granting of the MCTO, being November 29, 2025, the Company may be subject to a failure-to-file cease trade order. Senior Credit Agreement Waiver Update On September 26, 2025, the Company announced that it obtained a waiver under its senior credit agreement to provide the Company until December 1, 2025, to file the Annual Filings without triggering a default under its senior credit agreement (the "Initial Waiver"). The Initial Waiver did not waive the requirement under the Company's senior credit agreement to file the Q1 Filings on or before November 14, 2025. The Company is working with the administrative agent under the senior credit agreement to seek a waiver from lenders to provide it with additional time to file the Q1 Filings and the Annual Filings in order to avoid triggering a default under the senior credit agreement. The senior credit agreement has a 30-day cure period for a default of this nature. Senior Secured Notes Indenture Waiver Update At this time, the Company has determined not to seek a waiver in respect of its failure to file the Required Filings under the indenture (the "Indenture") governing its 8.625% senior secured notes due 2029 (the "Notes"), which will not constitute a default or an event of default under the Indenture if the Required Filings are filed on or before February 26, 2026. In the event the Company has not filed its Required Filings by December 27, 2025, the interest rate on the Notes will increase by 0.25% per year on the principal amount of such Notes from December 27, 2025, to and including February 26, 2026. 2025 Annual General Meeting In light of the fact that the Company has not yet filed its audited financial statements for FY 2025, the Company announced it has rescheduled the 2025 AGM to December 31, 2025. The record date for the 2025 AGM remains November 7, 2025. The Company intends to use the additional time before the 2025 AGM to complete the OSC Review and the filing of the Annual Financial Statements, which are required to be delivered to the Company's shareholders in advance of the 2025 AGM and presented at the 2025 AGM. Quiet Period Until Financial Reporting is Complete During the current period in which the Company has yet to file the Required Filings, the Company will continue to restrict its regular investor engagement and public commentary, including debtholder and investor meetings and calls. The Company will provide further information regarding its financial position and related matters by way of public announcement as and when required by law or the Company otherwise determines that disclosure is warranted. ABOUT DYE & DURHAM LIMITED Dye & Durham Limited provides premier practice management solutions empowering legal professionals every day, delivers vital data insights to support critical corporate transactions and enables the essential payments infrastructure trusted by government and financial institutions. The Company has operations in Canada, the United Kingdom, Ireland, Australia, and South Africa. Additional information can be found at www.dyedurham.com. Non-IFRS Financial Measures "Adjusted EBITDA" adjusts net loss by adding back financing costs, amortization, depreciation and impairment costs, taxes paid, stock-based compensation expense, loss on contingent receivables and assets held for sale, specific transaction-related expenses related to acquisition, listing and reorganization related expenses, integration and operational restructuring costs and other non-recurring expenses. Operational restructuring costs are incurred as a direct or indirect result of acquisition activities. "Adjusted EBITDA" is not defined by and does not have a standardized meaning under IFRS as issued by the International Accounting Standards Board. Non-IFRS financial measures are used by management to assess the financial and operational performance of the Company. The Company believes that this non-IFRS financial measure, in addition to conventional measures prepared in accordance with IFRS, enables investors to evaluate the Company's operating results, underlying performance and prospects in a similar manner to the Company's management. As there are no standardized methods of calculating these non-IFRS measures, the Company's approaches may differ from those used by others, and accordingly, the use of these measures may not be directly comparable. Accordingly, this non-IFRS measure is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The Company has reconciled Adjusted EBITDA to the most comparable IFRS financial measure in the accompanying tables. Unaudited Financial Information The financial figures noted in this press release are not final and are inherently uncertain due to a number of factors, and remain subject to review by the Company's management, audit committee and board of directors and the completion of regular financial closing and review procedures and audit procedures for FY 2025. The unaudited figures disclosed herein should not be viewed as a substitute for audited financial statements prepared in accordance with IFRS. Additional adjustments to the unaudited figures presented above may be identified, and final results for FY 2025 may differ materially from the figures presented herein and will not be finalized until after the OSC Review and the audit for fiscal 2025 are complete. These unaudited figures are intended to provide information about management's current expectations regarding certain aspects of Dye & Durham's financial performance. Reliance on the information presented herein may not be appropriate for other purposes. Forward-Looking Statements This press release may contain forward-looking information and forward-looking statements within the meaning of applicable securities laws, which reflects Dye & Durham's current expectations regarding future events. In some cases, but not necessarily in all cases, forward-looking statements can be identified by the use of forward looking terminology such as "plans", "targets", "expects" or "does not expect", "is expected", "an opportunity exists", "is positioned", "estimates", "intends", "assumes", "anticipates" or "does not anticipate" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "will" or "will be taken", "occur" or "be achieved". In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. Forward-looking statements are not historical facts, nor guarantees or assurances of future performance but instead represent management's current beliefs, expectations, estimates and projections regarding future events and operating performance. Specifically, statements regarding Dye & Durham's $15-20 million annualized operational efficiency and cost optimization program, the expected closing of the sale of Credas and the benefits therefrom, expected financial results for FY 2025 and the first quarter of FY 2026, Dye & Durham's expectation that it will be in compliance with its financial covenants under its senior credit agreement, the Required Filings, the timeline for filing the Required Filings, completing the OSC Review, the Company's 2026 strategic plan, a further waiver under its senior credit facility, and the timing of the 2025 AGM are forward-looking statements. Further, statements under the heading "Updated Outlook" relating to the product rationalization program, management's expectation that results will stabilize and begin to recover in the second half of FY 2026, positioning Dye & Durham for sustainable growth in FY 2027 and beyond are forward-looking statements. The foregoing statements reflect Dye & Durham's beliefs or objectives, which are not guarantees or assurances, but are based on the implementation of certain specific actions. The forward-looking information is based on management's opinions, estimates and assumptions, including, but not limited to, that the Company will be able to address the comments from the OSC to allow it to complete the OSC Review, that the Company will be able to obtain a further waiver under its senior credit facility or otherwise cure the technical default thereunder, that the Company will complete and file the Required Filings within a reasonable period of time, and that the Company will hold the 2025 AGM as scheduled. Further, the achievement of the benefits of the operational efficiency and cost optimization program depend on the continued successful implementation of the program on the timeline currently contemplated and at a cost consistent with the Company's current expectations. The benefits from the sale of Credas assume that the sale closes as expected. Dye & Durham's expectation regarding its financial results in the second half of FY 2026 and growth in FY 2027 assumes its business initiatives, including onboarding new customers, renegotiating contracts, pricing strategy and cost savings are implemented with the expected results and timing, and impact on profitability and performance measures. While these opinions, estimates and assumptions are considered by Dye & Durham to be appropriate and reasonable in the circumstances as of the date of this press release, they are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, levels of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking information. Such risks and uncertainties include, but are not limited to: a delay in the Company's management completing its work; the OSC may have additional questions in respect of the OSC Review; the Company's lenders being unwilling to provide a further waiver on commercially reasonable terms or at all; the Company being unable to cure a technical default under its senior credit agreement; the Company being required to further delay its 2025 AGM; the Credas sale not closing as expected; and the operational efficiency and cost optimization program not being implemented as expected. Further, if the MCTO is not granted, and the Company is not able to file the Required Filings by the 60th day from the initial granting of the MCTO, being November 29, 2025, the Company may be subject to a failure-to-file cease trade order. All forward-looking statements contained in this press release are also subject to the risks discussed under "Risk Factors" in the Company's most recent Annual Information Form and under the heading "Risks and Uncertainties" in the Company's most recent Management's Discussion and Analysis, which are available on the Company's profile on SEDAR+ at www.sedarplus.ca. If any of these risks or uncertainties materialize, or if the opinions, estimates or assumptions underlying the forward-looking information prove incorrect, actual results or future events might vary materially from those anticipated in the forward-looking information. There can be no assurance that any forward-looking information or forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. No forward-looking statement is a guarantee of future results. Accordingly, you should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this press release represents Dye & Durham's expectations as of the date specified herein and are subject to change after such date. However, the Company disclaims any intention or obligation or undertaking to update or revise any forward-looking information or to publicly announce the results of any revisions to any of those statements, whether as a result of new information, future events or otherwise, except as required under applicable securities laws. All of the forward-looking information contained in this press release is expressly qualified by the foregoing cautionary statements.

SOURCE Dye & Durham Limited | ||||||||||||||

Company Codes: Toronto:DND | ||||||||||||||