US Consumers Struggle with Longevity Preparedness According to Inaugural "Longevity Preparedness Index " from John Hancock and MIT AgeLab

US Consumers Struggle with Longevity Preparedness According to Inaugural "Longevity Preparedness Index" from John Hancock and MIT AgeLab |

| [15-October-2025] |

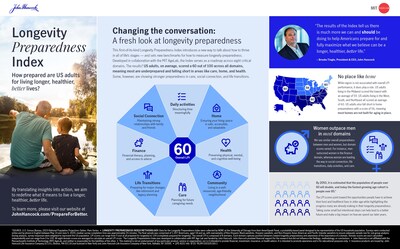

TSX/NYSE/PSE: MFC SEHK: 945 New Index Introduces Groundbreaking Benchmarks for Thriving Throughout the Aging Journey Across Eight Critical Domains; Finds Women Are Outpacing Men in Readiness and Planning for Care is a Gap BOSTON, Oct. 15, 2025 /PRNewswire/ - Today, John Hancock announces the findings of a first-of-its-kind Longevity Preparedness Index (LPI) revealing that US adults are generally underprepared to live well as they age. The index, which introduces a new conversation – and establishes benchmarks – around measuring longevity preparedness, was developed in collaboration with the MIT AgeLab, a multidisciplinary research program creating ideas, data, and innovations to improve quality of life across the lifespan. The research builds on John Hancock's longstanding commitment to providing customers with education, resources, incentives, and rewards that help them take better control of their health and wealth now and throughout retirement. The LPI measures US adults' preparedness to thrive as they age and serves as a road map across eight critical domains: social connection, daily activities, care, home, community, life transitions, health and finance. These domains were developed based on decades of longevity research conducted at the MIT AgeLab and other global universities and organizations. The domains are each evaluated on a scale of 0 to 100, along with an overall score that represents the average of the domain scores. In a survey of over 1,300 adults, US consumers on average scored a 60 out of 100 overall, revealing most adults are underprepared for longer lives, falling short in critical areas like care, housing, finance, and health. However, the LPI reveals some US adults – particularly women and caregivers – are showing stronger preparedness across several domains. "Our inaugural Longevity Preparedness Index introduces a new way of thinking about longevity – it's frankly no longer just about how much you've saved for retirement or even about how healthy you are; it's also about where you'll live, how you'll get where you need to go, how you'll fill your days, and who you will share your time with," said Brooks Tingle, President and Chief Executive Officer, John Hancock. "And the results of the Index tell us that while some people are preparing for longer lives, there is much more our industry can and should be doing to help customers. MIT AgeLab identified eight critical levers of longevity preparedness we need to pay closer attention to as an industry to better help Americans prepare for and fully maximize what we believe can be a longer, healthier, better life." "The LPI is more than a measurement; it is a research-based framework that seeks to redefine how we think about preparing for later life," said Dr. Joe Coughlin, Founder and Director of the MIT AgeLab. "While health and wealth security are key, between those two vital bookends are the routines and assumptions that make up daily life. The LPI seeks to spark public awareness and action to prepare people for living what is likely to be a full one-third of their adult lives." The US population aged 65+ is projected to surge from 58 to 82 million by 2050.1 And one-fifth of an individual's life, on average, is now expected to be lived in a state of illness,2 while almost four in 10 people will face financial instability as they age.3 More than ever, people need more than just financial resilience to feel secure and fulfilled as they age. Longevity Preparedness Index Key Findings

"Our goal with the LPI is simple: expand the conversation around what it means to prepare well for longer lives by taking a holistic perspective. LPI scores point toward the opportunities people have to achieve their best and healthiest lives while highlighting the progress many are already making in their longevity preparedness," said Dr. Coughlin. "Results from the LPI underscore that taking some small but intentional steps – such as planning for a new hobby, starting a fitness routine, or having a conversation about care – can lead to a better future and make a big impact on how we spend our later years. We're proud to work with John Hancock on this research and look forward to seeing what actions organizations, governments, and individuals take as a result of this groundbreaking way of approaching longevity preparedness in the US." Expanding Access to Prevention, Early Detection and Nutrition Tools Since 2015, John Hancock has offered life insurance customers education, resources, incentives, and rewards for the everyday things they do to support a longer lifespan and improved healthspan through its John Hancock Vitality Program. John Hancock will soon be providing Manulife John Hancock Retirement plan participants access to some of the leading health and wellness resources currently offered to Vitality members through their life insurance policies, including:

Additionally, John Hancock is continuing to enhance and expand its existing offerings for life insurance customers in support of their holistic longevity preparedness. John Hancock Vitality members will have expanded discounted access to Prenuvo's newest suite of offerings, including:5

"Through John Hancock Vitality, we've seen firsthand that it's possible to drive better health outcomes when we support customers in taking small steps toward a longer, healthier, better life," said Tingle. "And the LPI findings show the tremendous potential that still exists to help all generations better prepare. We're eager to implement the LPI findings into our solutions and services across insurance, retirement, and wealth management, to help people take action against all the dimensions that can help them prepare for longevity. Together – across public and private sectors – we can turn insight into impact." The LPI, which will be updated annually over the next four years, is part of a five-year research collaboration between John Hancock and MIT AgeLab announced in 2024. Drawing on the social and behavioral sciences, engineering, data science, and design, the AgeLab works with leading companies, policymakers, and NGOs worldwide to reimagine the future of longevity and aging. Read more about the LPI and see the full results of the study at www.johnhancock.com/prepareforbetter.

Longevity Preparedness Index Methodology LPI scores can range from 0 (not at all prepared for longevity) to 100 (completely prepared for longevity). The overall LPI is composed of 8 domains. Each domain captures positive behaviors toward longevity preparedness and awareness of the importance of a domain. Domain scores are each calculated independently and can range from 0 to 100. All eight domain scores are averaged to calculate an overall LPI score. The Longevity Preparedness Index was developed in collaboration with MIT Age Lab and funded by John Hancock. John Hancock provided financial support for the research but did not influence the findings, methodology, or conclusions. John Hancock is not affiliated with the Massachusetts Institute of Technology (MIT) AgeLab, and neither is responsible for the liabilities of the other. About John Hancock and Manulife One of the largest life insurers in the United States, John Hancock supports more than ten million Americans with a broad range of financial products, including life insurance and annuities. John Hancock also supports US investors by bringing investment capabilities and retirement planning and administration expertise to individuals and institutions. Additional information about John Hancock may be found at johnhancock.com. Vitality is the provider of the John Hancock Vitality Program in connection with life insurance policies issued by John Hancock. John Hancock Vitality Program rewards and discounts are available only to the person insured under the eligible life insurance policy, may vary based on the type of insurance policy purchased and the state where the policy was issued, are subject to change and are not guaranteed to remain the same for the life of the policy. To be eligible to earn rewards and discounts by participating in the Vitality program, the insured must register for Vitality and in most instances also complete the Vitality Health Review (VHR). John Hancock insurance products are issued by: John Hancock Life Insurance Company (U.S.A.), Boston, MA 02116 (not licensed in New York) and John Hancock Life Insurance Company of New York, Valhalla, NY 10595. MLINY100225129-1 Media Contact:

SOURCE John Hancock | |||||||||

Company Codes: HongKong:0945,Manila:MFC,NYSE:MFC,Toronto:MFC |