Jet.AI Inc. JV for 50MW Data Center Campus in Moapa, Nevada

50MW data center estimated enterprise value of ~$500MM

LAS VEGAS, NV, Dec. 23, 2025 (GLOBE NEWSWIRE) -- Jet.AI Inc. (NASDAQ: JTAI) (“Jet.AI” or the “Company”), an emerging provider of high-performance GPU infrastructure and AI cloud services, today announced a planned joint venture with Choo Choo Express LLC (“CCE”), relating to the development of a planned 50-megawatt data center campus in Moapa, Clark County, Nevada.

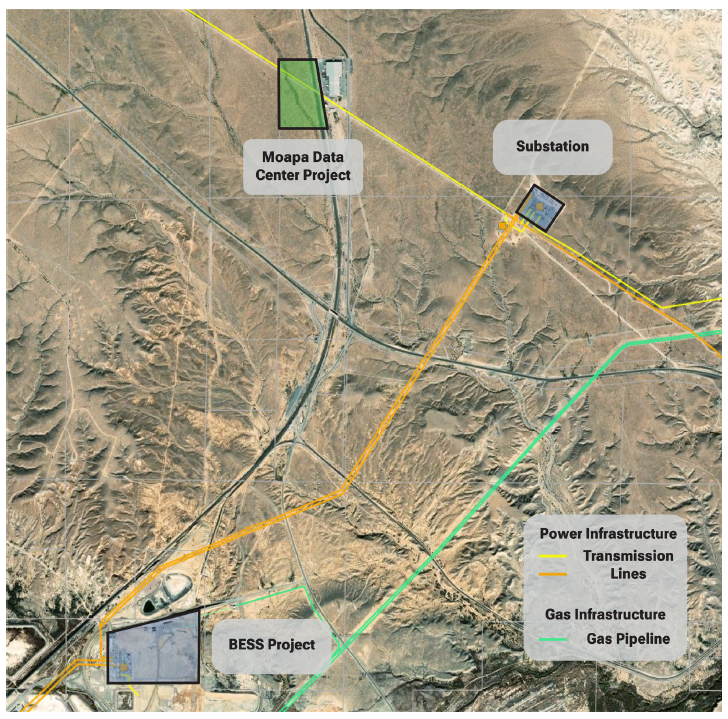

Moapa Data Center Project Map

Description: The image shows an aerial map of a planned data center campus in Moapa, Nevada, highlighting a 20-acre parcel located along existing utility corridors near a major roadway. The campus is positioned adjacent to a fully remediated former coal plant now operating as a 200-megawatt battery energy storage facility, with nearby electrical transmission lines, a substation, and a natural gas pipeline visible in close proximity.

The proposed joint venture is expected to pursue the development of a data center and related infrastructure on approximately 20 acres of land located in Moapa, Nevada. CCE expects to contribute the land to the joint venture, subject to the execution of definitive agreements, completion of diligence, and satisfaction of customary conditions.

Located less than an hour from the Las Vegas strip, the Moapa campus is one of the few remaining sites in the Southwest capable of supporting hyperscale inference workloads deployed closer to end users at the edge of the network. Its geographic position offers the potential for low-latency connectivity into California and key Southwestern markets. The campus is situated adjacent to a remediated coal-fired power plant and benefits from substantial existing utility infrastructure, including access to electric transmission, natural gas, fiber connectivity, water, and transportation corridors.

Under the terms of the proposed joint venture, Jet.AI expects to commit approximately $10 million of capital over an anticipated two-year period, subject to the achievement of defined development and infrastructure milestones. Capital contributions are structured to align with milestones and may be internally financed at the option of the Company and CCE once the land is fully powered and appraised. Milestones include feasibility studies, entitlements, utility extensions, and power procurement activities.

“Certain CCE personnel bring direct, hands-on experience in the design, construction, and operation of large-scale data centers for Core Scientific,” said Jet.AI Executive Chair Mike Winston. “CCE brings a related workforce of thousands of contractors, alongside deep local knowledge of the Moapa area and forty years of in state development experience. Today’s announcement builds upon Jet.AI’s earlier disclosure this year regarding its pursuit of a data-center campus in Clark County.”

Data Center Economics (illustrative example)

For illustrative purposes, management believes a fully developed 50-megawatt data center typically carries an enterprise value of approximately $500 million, made up of roughly $400 million of project debt and $100 million of equity. Of that equity, approximately $65 million is assumed in this example to be institutional preferred capital, with the remaining $35 million representing common equity, or “promote.” Under the proposed joint venture structure, that equity promote is expected to be allocated approximately 70% to Jet.AI and 30% to CCE, implying a prospective value of approximately $25 million to Jet.AI at stabilization.

As project debt is paid down over time, the equity value would be expected to increase. In a fully de-levered scenario, management estimates the equity portion could represent approximately 25% of total enterprise value, or $125 million. Based on an assumed $10 million investment, this illustrative scenario would imply a prospective return of approximately 1.5x over the initial development period and up to 11.5x over a longer-term horizon as debt is repaid, subject to the assumptions and risks described in the forward-looking statements below.

These assumptions are based on a 10% capitalization rate; lower capitalization rates would be expected to increase the implied equity value. For example, at a 6% capitalization rate, which is customary in refinancing transactions, the illustrative figures would increase to approximately $41 million (3.1x) and $208 million (19.8x). As with all forward-looking estimates, actual results may vary based on market conditions, financing terms, and other factors discussed elsewhere in this release.

Exclusivity

The term sheet provides for an exclusivity period during which the parties will work in good faith to negotiate definitive documentation and further pursue entitlements, utility availability, and customary environmental work.

About Jet.AI Inc.

Jet.AI Inc. is a technology-driven company focused on deploying artificial intelligence tools and infrastructure to enhance decision-making, efficiency, and performance across complex systems. The Company is listed on the NASDAQ Capital Market under the ticker symbol “JTAI.”

About Choo Choo Express LLC

CCE is related to a Nevada-based infrastructure development and construction firm with more than four decades of operating history across power, water, sewer, gas, and large-scale utility installations. CCE works closely with this licensed general contractor and developer with experience delivering complex infrastructure projects across more than ten U.S. states. One of the principals of CCE has extensive experience building and designing data centers for Core Scientific and serves as a director of the AI Infrastructure Acquisition Corp. (NYSE: AIIA) whose sponsor entity is 49.5% owned by Jet.AI Inc.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding the anticipated development of the Moapa data center project, expected capital commitments, strategic benefits of the campus location, low-latency performance, future negotiations of definitive agreements, and the Company’s infrastructure strategy. These statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Jet.AI undertakes no obligation to update or revise any forward-looking statements, except as required by law.

The valuation and return estimates are illustrative only and are provided for conceptual purposes to demonstrate how project economics may scale. They are not forecasts or projections of actual results and are subject to significant assumptions, risks, and uncertainties, including capital structure, financing terms, leasing outcomes, market conditions, capitalization rates, and timing of development. Actual results may differ materially, and there can be no assurance that any such values or returns will be achieved.

For additional information, please refer to Jet.AI’s filings with the Securities and Exchange Commission.

Jet.AI Investor Relations:

Gateway Group, Inc.

949-574-3860

Jet.AI@gateway-grp.com

Choo Choo Express LLC (“CCE”):

Dave Brown

702-917-0337

dbrown@ldalv.com

Attachment

© 2025 GlobeNewswire, Inc. All Rights Reserved.

How Privileged Access Tools Reduce Cybersecurity Risks