MOD Feasibility Study Confirms Robust Capital Intensity and 31%+ IRR;┬ĀMaiden Ore Reserve

The Full Announcement is Available in PDF here:┬Ā

http://ml.globenewswire.com/Resource/Download/339b9466-3158-4fb4-b347-9e79e7d23bf8┬Ā

VANCOUVER, British Columbia, Aug. 25, 2025 (GLOBE NEWSWIRE) -- Marimaca Copper Corp. (ARBN683017094) (ŌĆ£MarimacaŌĆØ or the ŌĆ£CompanyŌĆØ) (TSX: MARI) (ASX: MC2) is pleased to announce the results of the Definitive Feasibility Study (ŌĆ£DFSŌĆØ) for its Marimaca Oxide Deposit (ŌĆ£MODŌĆØ) which considers a nominal 50 ktpa of copper cathode production target for an estimated 13-year reserve life.

The Company will host an investor presentation, covering the DFS, via the Investor Meet Company (ŌĆ£IMCŌĆØ) platform on August 26, 2025. Further details can be found below.

Highlights

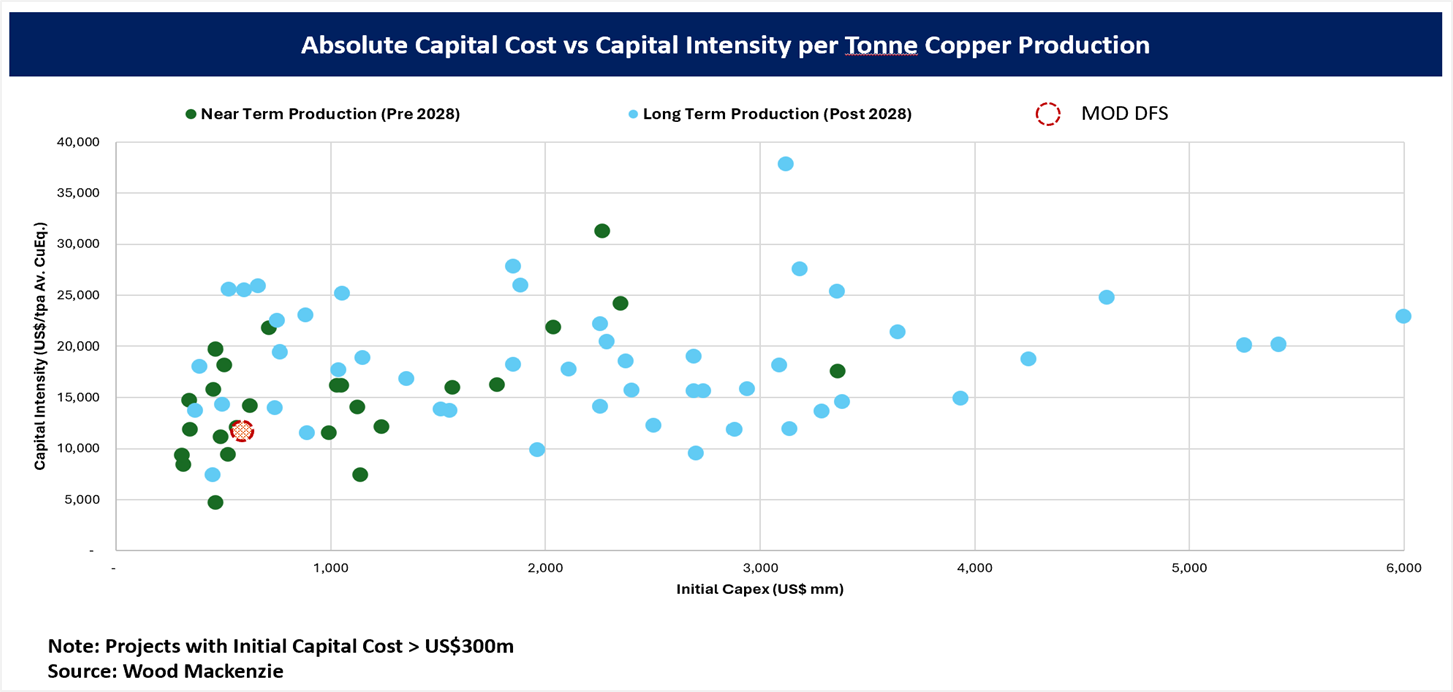

- Pre-production capital cost and capital intensity of US$587m and US$11,700/tonne of copper production capacity, respectively, positions the MOD as one of the lowest capital cost and intensity development stage copper projects globally

- Simple open pit mining with life of mine strip ratio of 0.8:1 including pre-stripped material

- Steady state (years 2-10) production of approx. 49 ktpa (108 million lbs) of Grade A LME copper cathode

- First five years of 50ktpa copper, LOM average of 43ktpa copper

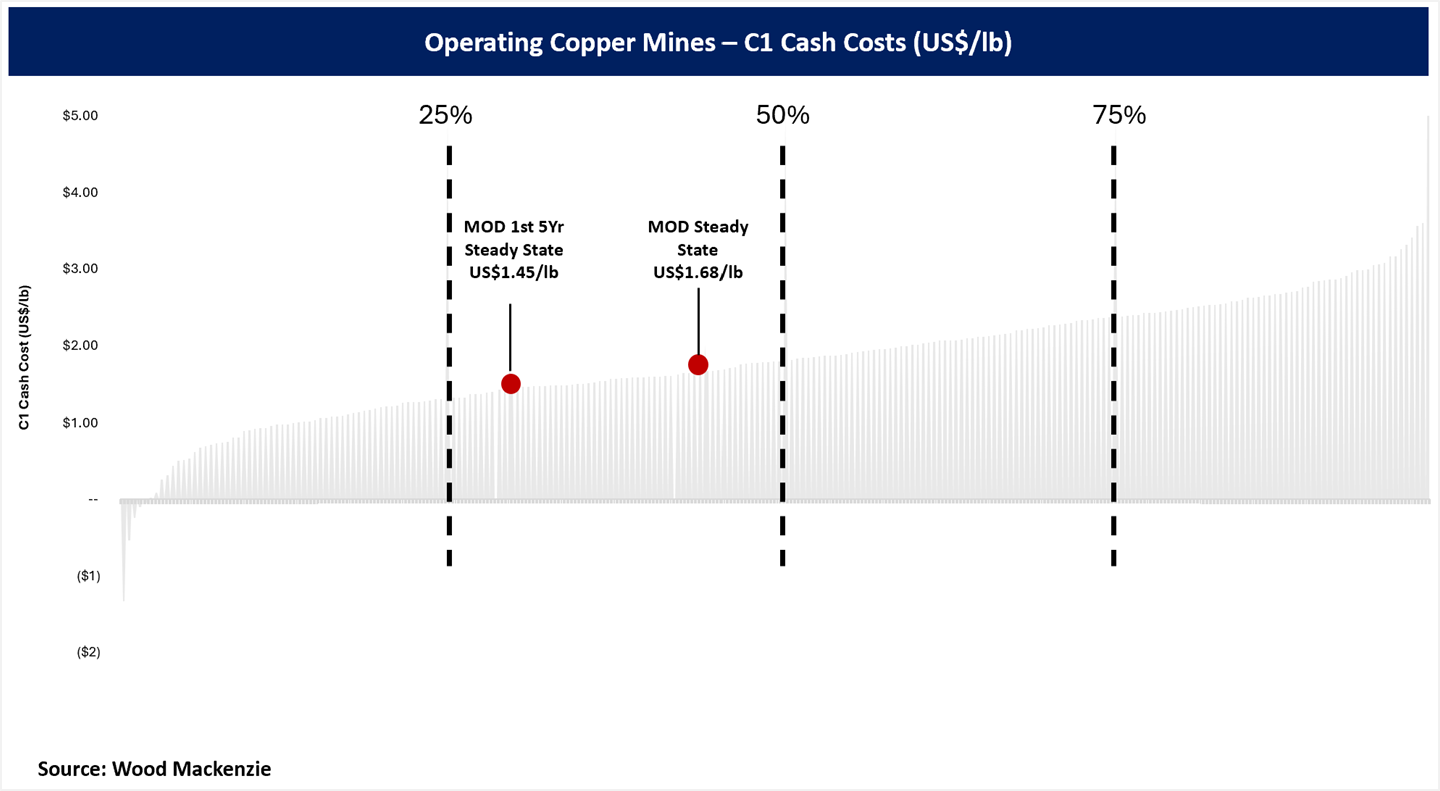

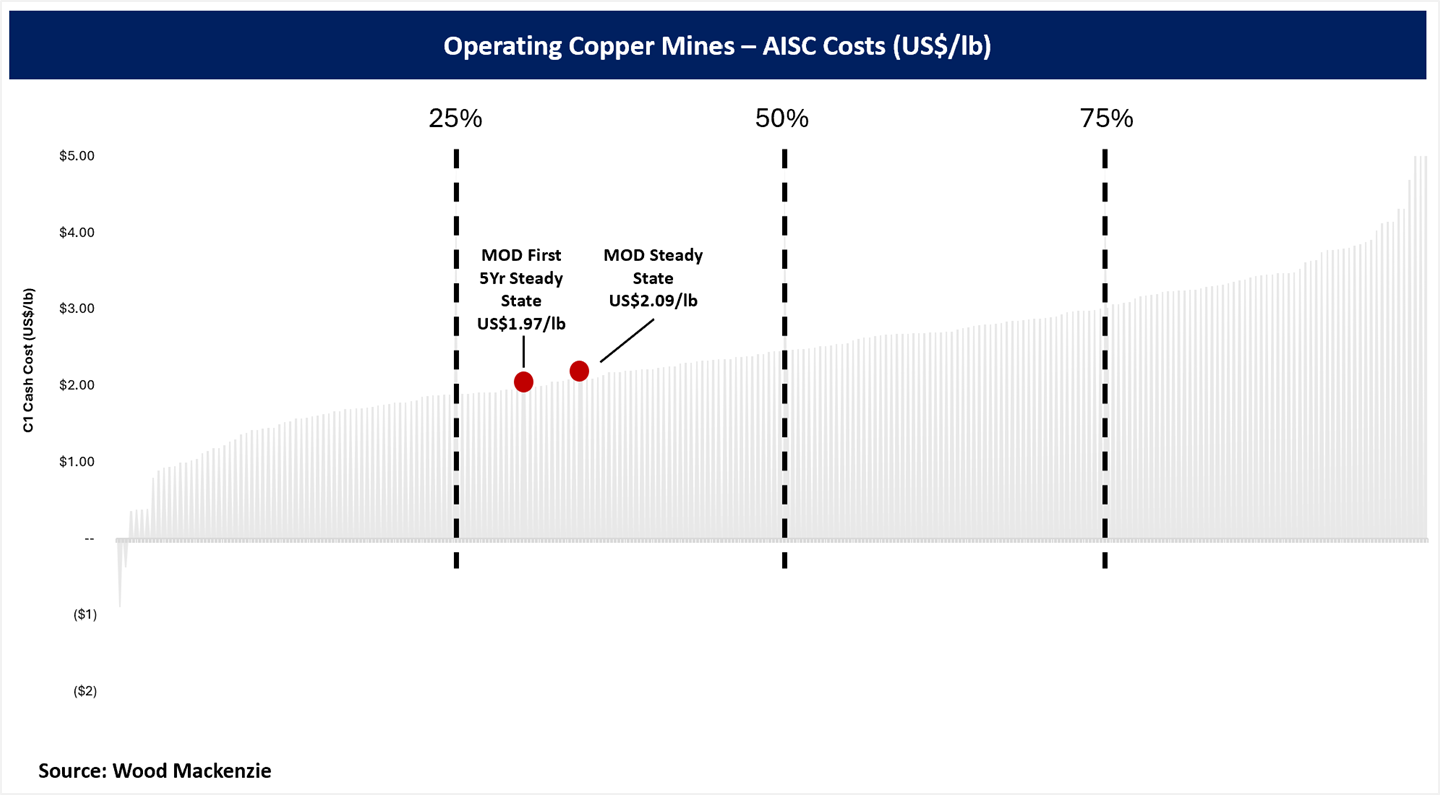

- First five years of steady state production estimated C1 cash costs of US$1.45/lb; AISC cost of US$1.97/lb

- Steady state (years 2-10) estimated C1 cash costs of US$1.68/lb; AISC of US$2.09/lb

- LOM C1 cash costs of US$1.84/lb; AISC of US$2.29/lb

- Dynamic geo-metallurgical model with recoveries based on data collected from seven comprehensive phases of metallurgical testing

- LOM heap leach copper recoveries of 72%, first five years of 78%

- Robust forecast economics and strong estimated cashflow generation at various copper prices

- Post Tax NPV8 of US$709m (US$900m pre-tax) and IRR of 31% (33% pre-tax) using a long-term copper price of US$4.30/lb copper (slightly below LT consensus), 2.5yr capital payback

- Post Tax NPV8 of US$1.07bn (US$1.39bn pre-tax) and 39% IRR (43% pre-tax) at the 3-month rolling average COMEX price of US$5.05/lb

- Maiden Proven and Probable Mineral Reserves of 178.6Mt with an average grade of 0.42% CuT for 750kt of contained copper based on Measured & Indicated Resources (i.e. Inferred material currently reports to waste for the purposes of the DFS plan)

- The Company believes that the MOD DFS represents the starting point in its organic growth strategy with numerous defined growth opportunities

- Inferred Resource currently treated as waste in the DFS mine plan

- Pampa Medina and Madrugador Oxides which the Company believes has the potential to underpin a future regional hub-and-spoke oxide opportunity

- Sulphide exploration potential at both Marimaca and Pampa Medina as demonstrated in recent drilling success

- Initial designs include oversized key equipment and infrastructure allowing for cost effective potential future scale expansions including the primary crusher, conveyors, water pipeline and infrastructure, power connection, footprints of the heap leach, and ripios dump

- The DFS incorporates purpose-built water infrastructure to mitigate risks associated with utilizing existing mine water infrastructure in the region

- Capital cost estimate is based on approximately 80% budget quotes, including an Engineering Procurement Construction (ŌĆ£EPCŌĆØ) quote for the SX-EW plant

- Opportunity to reduce initial capital costs by utilizing an alternative contracting strategy

- Project permitting well underway and receipt of environmental approvals (RCA) are anticipated before the end of 2025

- Sectoral Permits will be required post-environmental approval to allow full construction to commence and to support the operations phase

- Debt financing workstreams are underway, with advisors and technical experts engaged ŌĆō objective of identifying preferred financing partners by year-end 2025

Hayden Locke, President & CEO of Marimaca Copper, commented:

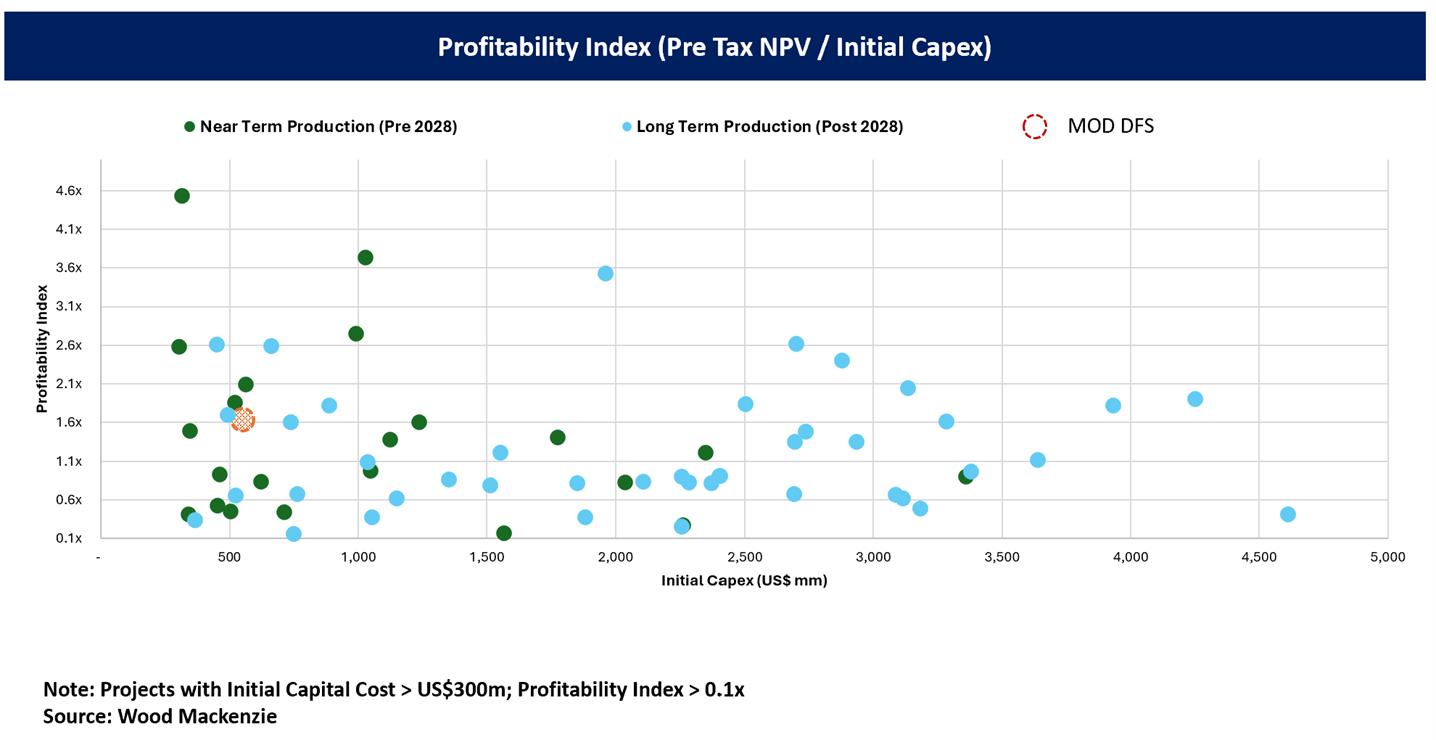

ŌĆ£The DFS confirms the MODŌĆÖs position as one of the most attractive copper development opportunities globally, especially when compared to those with a production capacity greater than 50ktpa. There are very few copper projects with lower capital intensity, and our competitive operating cost profile, positioned in the second quartile of Wood Mackenzie-benchmarked copper projects globally on an all-in-cost basis, drives superior return on invested capital metrics at virtually any copper price. Cashflows are robust, even at copper prices well below todayŌĆÖs long term consensus copper price, which will support our well progressed debt financing discussions.

ŌĆ£Our base case economics are assessed using a flat long term copper price of US$4.30/lb, which is slightly below the current consensus long term price. We note other recent Feasibility Studies in our developer peer group have used a headline price of above US$4.80/lb. At that price, the MOD delivers nearly US$1bn of post-tax NPV8 with an IRR of 36.5%. This result confirms again that the MOD is quite exceptional from a ROIC perspective.

ŌĆ£We have quoted all material equipment from reputable providers to ensure long term reliability and operability. Massive and civil earthworks were quoted by a large Chilean contractor with expertise in mining earthworks. Quotes for construction and assembly of key packages were received from local and international contractors, including an Engineering Procurement Construction (ŌĆ£EPCŌĆØ) quote for the SX-EW plant. This passes risk to the contractor but naturally increases the overall cost to the Company. The Company believes there is an opportunity to further optimize the capital cost by utilizing a hybrid contracting strategy.

ŌĆ£Operating costs have been built from first principles and include maintenance schedules recommended by equipment providers over the life of mine. The MOD benefits both from its extremely low life of mine strip ratio, but also its geometry, which means even at the end of the current mine plan, the vertical haulage distance is less than 200m, meaning mining costs are significantly lower both on per tonne of material moved and per tonne of ore delivered to the heap leach pads.ŌĆØ

ŌĆ£The DFS excludes the inferred resources of 21Mt with an average grade of 0.29% CuT. Approximately 10Mt of inferred material is moved as part of the DFS mine plan, all of which reports to waste. We expect, with minimal additional drilling, that we can continue our strong conversion of mineral resources to ore reserves, which is approximately 84% for the Measured and Indicated resource categories.

ŌĆ£We are well progressed on a PEA for Pampa Medina, which has been briefly paused due to recent drilling success, and we now see strong potential to increase our production target scale from the contemplated 50ktpa of copper cathode production with oxides from the Pampa Medina and Madrugador deposits (although no forecast is made of that at this stage). We strongly believe 50ktpa of copper production is a starting point for the Company as we continue our journey towards being a significant global copper producer.

ŌĆ£Our permitting is progressing well and we have now submitted our responses to the first ICSARA (list of questions and clarifications) from the regulatory authorities. We expect one further round of follow-up questions and information requests after which the authorities should be in a position to provide environmental approvals for the MOD. We are targeting receipt of environmental approvals by the end of 2025, allowing construction to commence in 2026.

ŌĆ£The multi-pronged strategy of Marimaca remains to bring the MOD into production as quickly as is feasible, while continuing to progress our pipeline of projects, at various stages of maturity, in parallel. This will include further technical work on the Pampa Medina and Madrugador Projects with the objective of increasing our potential production capacity to over 70ktpa of copper cathode within the next 5 years. In parallel, we will continue to explore high priority targets including the Pampa Medina Deposit, where material possibilities for resource growth have been identified, and to test the sulphide potential below the MOD, which has never been drilled.

ŌĆ£Overall, we are pleased with the results following a significant amount of technical work completed in the last two years. We see opportunities for further improvement to what is already an exceptional project as we progress through detailed design and engineering, and we are excited to commence the next phase of our development.ŌĆØ

Investor Presentation

Marimaca will host an investor presentation via the IMC platform on Tuesday, August 26 2025, covering todayŌĆÖs announcement. The online event will take place at 03:00 a.m. (Vancouver) / 06:00 a.m. (Toronto) / 11:00 a.m. (London) / 6:00 p.m. (Perth) with Hayden Locke (President & CEO) presenting from the Company. The presentation is open to all existing and potential shareholders. Questions can be submitted at any time during the presentation.

Investors can sign up to IMC for free and add to meet Marimaca Copper via:

https://www.investormeetcompany.com/marimaca-copper-corp/register-investor

Executive Summary

The DFS contemplates truck and shovel mining operation to produce ore from a single open pit, three-stage crushing, agglomeration and dynamic heap leaching to produce a target of 50ktpa of copper cathode with an initial 13-year reserve life.

The resource is contained in a single open pit, developed over eight phases. The life-of-mine strip ratio, which includes inferred material as waste and the initial pre-strip, is 0.8:1. Initial throughput of 12 Mtpa of heap leach material expands to 16 Mtpa in the second phase starting in year 6 of the mine plan.

Mineral resources are based on approximately 140 km of reverse circulation and diamond drilling, completed from 2016 to 2022, and the database incorporates sequential copper (acid soluble & cyanide soluble copper), analytical acid consumption and mineralogy. Mineral reserves are based on the Measured and Indicated Resource categories, post the application of various modifying factors, including operating costs, recoveries and mining assumptions.

Ore is crushed via a three-stage crushing configuration to a product size of 80% passing 12.5 mm (-┬ĮŌĆØ). Post crushing, ore is agglomerated and acid cured and stacked on dynamic heap leach pads with maximum lift height of 4 meters. Ore is irrigated with leaching solution comprising of untreated seawater and sulfuric acid. Acid dose in curing, acid concentrations in leaching, overall leaching ratios and leaching periods are variable depending on mineral sub-domain. The mine plan does not consider selective mining of mineralogical domains, but there is natural selectivity within the mine plan based on the geometry and natural domaining of the deposit. The early years comprise dominantly green oxides (brochantite and chrysocolla) moving to more enriched (secondary sulphides comprising chalcocite and covellite) and WAD material in the second half of the mine plan.

Copper recoveries are variable depending on mineral sub-domain. Recovery equations have been developed from seven phases of metallurgical test work, including numerous column leach tests using the operating parameters contemplated in the DFS. Recovery equations are dynamic and dependent on mineral sub-domain, grade, leaching potential and have been assigned on a block-by-block basis within the DFS mine plan. Acid consumption assumptions are also based on all of the phases of metallurgical test work, and utilize the analytical acid consumption database, which has been acquired for all of the 140 km of drilling included in the MOD drilling package.

Capital costs have been estimated on the basis of the material take-offs developed by Ausenco in engineering for quantities and detailed mechanical equipment lists. Budget quotations were obtained for approximately 80% of the mechanical equipment in support of the capital cost estimate. For mechanical equipment, quotes have been obtained from multiple reputable firms. Massive and civil earthworks rates have been obtained from Excon, one of the largest earthmoving contractors in Chile. Construction and assembly costs have been obtained from local Chilean contractors on a procurement and execution basis. The quote for the SX-EW facility was provided by Tenova on an EPC basis.

For the purposes of the DFS, the water and power infrastructure, to the mine gate, have been included on the basis of Build Own Operate Transfer (ŌĆ£BOOTŌĆØ) proposals provided by local and international firms with presence in Chile. This reduces the upfront capital cost, with the cost reflected as an ongoing operating cost to the Project.

| Metric | Unit | First 5 Years of Steady State(1) | First 10 Years(2) | LOM |

| Mining Summary | ┬Ā | ┬Ā | ┬Ā | ┬Ā |

| Total Ore Mined | kt | 80,683 | 173,994 | 178,635 |

| Total Waste Mined | kt | 73,803 | 144,778 | 145,889 |

| Strip Ratio | w:o | 0.91x | 0.83x | 0.82x |

| Production Summary | ┬Ā | ┬Ā | ┬Ā | ┬Ā |

| Average Annual Ore Sent to Heap Leach | Mtpa | 12.4 | 13.6 | 14.1 |

| Head Grade Cu | % Cu | 0.52% | 0.48% | 0.42% |

| Cu Recovery | % Cu | 77% | 73% | 72% |

| Average Annual Cu Recovered | ktpa Cu | 50 | 48 | 43 |

| Operating Costs | ┬Ā | ┬Ā | ┬Ā | ┬Ā |

| Mine Operating Costs | US$/t mined | $1.2 | $1.4 | $1.5 |

| Processing Costs | US$/t processed | $8.9 | $8.9 | $8.8 |

| G&A Costs | US$/t processed | $0.3 | $0.3 | $0.3 |

| Total Operating Costs | US$/t processed | $12.3 | $12.5 | $11.9 |

| Sales & Royalty | US$/lb Cu | $0.10 | $0.07 | $0.06 |

| C1 Cash Costs(3) | US$/lb Cu | $1.45 | $1.68 | $1.84 |

| AISC(4) | US$/lb Cu | $1.97 | $2.12 | $2.29 |

| Capital Expenditures | ┬Ā | ┬Ā | ┬Ā | ┬Ā |

| Initial Capital | US$m | $587 | ||

| Expansion Capital | US$m | $77 | ||

| Sustaining Capital | US$m | $283 | $484 | $529 |

| Closure Cost | US$m | $47 | ||

| Salvage Value | US$m | $43 | ||

| Financial Metrics | ┬Ā | ┬Ā | ┬Ā | ┬Ā |

| Long Term Copper Price | US$/lb Cu | $4.30 | ||

| Average Annual EBITDA | US$m | $326 | $288 | $241 |

| Post-Tax Average Annual Unlevered Free Cash Flow(5) | US$m | $222 | $188 | $160 |

| Pre-tax NPV8% | US$m | $900 | ||

| Post-tax NPV8% | US$m | $709 | ||

| Pre-tax IRR | % | 33% | ||

| Post-tax IRR | % | 31% | ||

| Payback Period | years | 2.5 | ||

Notes: 1. First 5 years of steady state (Years 2-6)

2. First 10 Years production includes material moved for pre-stripping in Year -1 and ramp-up period in Year 1.

3. C1 Cash Costs includes the mining, processing, G&A, marketing & sales, and royalty costs. These are Non-GAAP performance measures.

4. AISC includes sustaining capex, closure capex, and salvage value.

5. Average Annual Unlevered Free Cash Flow during operating years only (years 1-13)

Table 1: Summary of MOD DFS Production Target and Financial Metrics

Initial Capital Cost

The initial capital cost estimate provides for US$587m for 50 ktpa of copper production capacity per annum, with a capital intensity per tonne of production capacity of US$11,700/tonne.

All capital cost estimates have been developed considering the American Association of Cost Engineers (ŌĆ£AACEŌĆØ) Class 3 guidelines, with an expected accuracy of┬Āof -10% to -20% / +10% to +30%. A contingency of 10%, on average, has been applied across the direct and indirect capital costs of the Project.

Capital costs have been developed using material take-offs (ŌĆ£MTOsŌĆØ) developed by Ausenco in the DFS engineering which included detailed equipment lists and quantities. Equipment, materials, earthworks and construction were then quoted using reputable local and international firms.

The mining fleet is assumed to be financed under a lease to own arrangement. The water and power infrastructure to the mine gate is assumed to be developed by third parties under a Build Own Operate Transfer (ŌĆ£BOOTŌĆØ) contract structure with large international and local infrastructure firms operating in Chile.

| Metric | Unit | Total LOM | |

| Initial Capital Cost | ┬Ā | ┬Ā | |

| Mine | US$m | $24 | |

| Crushing | US$m | $141 | |

| Heap Leach & SX-EW | US$m | $223 | |

| Infrastructure | US$m | $49 | |

| Total Direct Costs | US$m | $437 | |

| Indirect costs | US$m | $80 | |

| Owner costs | US$m | $17 | |

| Contingency | US$m | $53 | |

| Total Initial Capital Cost | US$m | $587 | |

Table 2: Initial Capital Costs for the MOD Project

The estimates for initial capital cost put the MOD among the lowest absolute capital costs and capital intensities for any greenfields copper projects globally. According to Wood MackenzieŌĆÖs global copper project database, there are seven projects with lower capital intensity in the developer universe with initial capital more than US$300m and production targets of greater than 100Mlbs of copper per annum. The MOD is among the lowest capital intensity and absolute capital cost copper development projects in this dataset.

Figure 1: Capital Cost Intensity for Global Copper Development Projects in Wood Mackenzie Database Highlighting the MODŌĆÖs Attractive Capital Intensity

Operating Costs

Operating costs were built from first principles using schedules for labour, energy consumption, consumables (diesel, lubricants, reagents, acid, water) and equipment manufacturer specified maintenance schedules over the life of mine.

Mining costs were provided via specialist Chilean mining consultancy NCL and were benchmarked against operations with identical fleets and similar mine production profiles operating in Chile. Mining rates were developed from first principles with industry standard assumptions on utilization rates and adjusted for MOD specific operating parameters using a Mining Cost Adjustment Factor (ŌĆ£MCAFŌĆØ). This accounts for changes in vertical and lateral haulage distances as the open pit develops over the life of mine. Mining operating costs include interest and capital costs associated with a leasing equipment contract structure with Komatsu.

Processing costs were also developed from first principles utilizing schedules for labour, reagent consumption from the geometallurgical model and metallurgical test work. These were applied using the geometallurgical model to account for acid consumption, and for industry standard rates for the SX-EW facility.

| Total Estimated Operating Costs | LOM Total (US$m) | LOM Average (US$/t processed) | LOM Average (US$/lb Cu) | |||||

| Mining (excl. deferred stripping) | $498 | $2.79 | $0.42 | |||||

| Processing (excl acid)(1) | $1,037 | $5.80 | $0.87 | |||||

| Acid | $530 | $2.97 | $0.45 | |||||

| G&A | $53 | $0.30 | $0.04 | |||||

| Sub-Total | $2,119 | $11.86 | $1.78 | |||||

| Total C1 Cash Cost(2) | $1.84 | |||||||

| Sustaining Capital Cost | $529 | $2.96 | $0.44 | |||||

| AISC(3) | $2.29 | |||||||

Notes: 1. Includes cost for Port and BOOT Agreements.

2. C1 Cash Costs includes transport, selling and royalty costs in addition to the sub-total presented. These are Non-GAAP performance measures.

3. AISC includes sustaining capex, closure capex, and salvage value.

Table 3: Total Operating Costs Estimate

The Company has benchmarked the MOD utilizing Wood MackenzieŌĆÖs database of 237 operating copper mines. Several of the mines have negative C1 and AISC costs on account of by-product credits. These have been included for completeness of the analysis.

The MOD has projected C1 cash costs for the first five years of steady state operations are US$1.45/lb. For the first 10yrs of operations, including the ramp up period in year 1, C1 cash costs are projected to be US$1.68/lb.

This places the MOD at the bottom end and middle of the 2nd quartile of the peer group for these periods, respectively, when compared to the benchmarked universe of copper assets, per Wood Mackenzie.

Figure 2: C1 Cash Cost Curve for Operating Copper Mines from Wood Mackenzie Showing┬ĀCompetitive MOD C1 Cost Base in 2nd Quartile

On an AISC cost basis, the Project has projected costs of US$1.97/lb for the first 5yrs of steady state operation and US$2.09/lb during steady state operations (years 2-10). For the first 10yrs of operations, including the ramp up period in year 1, AISC costs are projected to be US$2.12/lb.

This places the MOD in the bottom of the 2nd quartile during steady state operations (including ramp-up) when compared to the peer group of benchmarked copper assets per Wood Mackenzie.

Figure 3: AISC Cost Curve for Operating Copper Mines with MOD Steady-State AISC in 2nd Quartile

Economic Analysis

The Company has completed sensitivity analysis using a range of copper prices, underlying input cost assumptions and discount rates to stress-test the business case and identify key areas of risk to the business plan.

Similar to many mining projects, the MODŌĆÖs ROIC is quite sensitive to underlying copper price assumptions, with an IRR of 31% and NPV8% of US$709m based on a flat pricing assumption of US$4.30/lb Cu, which is just below the current long term (ŌĆ£LTŌĆØ) consensus copper price of US$4.36/lb. At the trailing 3-month COMEX copper price of US$5.05/lb, the Project delivers an exceptional NPV8 (post tax) of US$1.1bn with an IRR of 39%.

In contrast to most of the peer group of development assets, the Project delivers robust economics even when assuming copper prices well below the LT consensus price. The MOD delivers robust cashflow generation and Return on Invested Capital (ŌĆ£ROICŌĆØ) metrics for any reasonable assumption of downside copper price assumptions.

Marimaca has analyzed the Wood Mackenzie AISC cost curve for copper producers, which indicates the 75th percentile of the universe of 237 operational copper assets starts at an AISC of US$3.00/lb, and the 85th percentile at approximately US$3.50/lb. Using a flat US$3.50/lb LT flat copper price assumption, the MOD delivers a post-tax NPV8 of US$347m and an IRR of 21% with a payback period of just over 3 years. Given the long-term demand forecasts for copper, the company believes this is a reasonable downside price assessment on which to stress project economics.

Among Wood MackenzieŌĆÖs database of 83 development stage copper assets with publicly available technical studies, the MOD has a profitability index (Pre-Tax NPV / Initial Capital Cost) in the top quartile of the peer universe. When combined with its outstanding geographical location, in a recognized and mature mining jurisdiction, the MOD clearly benchmarks as an exceptional project from a financial risk perspective.

Figure 4: Profitability Index for Global Copper Projects in Wood Mackenzie Database Indicating the┬ĀSuperior Return on Capital of the MOD

In summary, the MOD is a financially robust asset, which generates superior returns when benchmarked against the majority of development and producer peers. As a result, the Company expects the project to be financeable via traditional debt and equity structures, and to generate strong returns for investors.

The Company will now turn its attention to the next phase of development activities, continuing to move the project towards production. Marimaca is formulating a development plan which will encompass further grade control drilling, additional confirmatory and optimization metallurgical test work, detailed design and engineering, early site preparation works (to commence on receipt of environmental approvals) and deposits on long lead items. The Company will also continue to progress its growth development strategy for the Pampa Medina and Madrugador oxide deposits and its parallel exploration strategy to unlock further value in its extensive exploration portfolio.

At the end of June 2025, the Company had over US$24m in cash available, which is sufficient to finance its ongoing development activities.

Funding

The debt financing process has commenced, with debt advisors and Independent Technical Experts (ŌĆ£ITEŌĆØ) engaged and reviewing the DFS in preparation for formal launch of a broad debt process to support project development. Marimaca has completed an initial outreach program to various debt providers with expressions of interest of up to US$500m based on initial, pre-DFS, financial models prepared by the Company. The indicative feedback received from these groups suggests the MOD is debt financeable. The CompanyŌĆÖs aim is to identify its preferred debt partners and to announce credit approved term sheets, subject to long form documentation, towards the end of 2025.

The Company has several large shareholders on its register including two strategic investors in Assore International Holdings (ŌĆ£AssoreŌĆØ) and Mitsubishi Corp (ŌĆ£MitsubishiŌĆØ). Both Assore and Mitsubishi have significant equity financing capacity and have indicated their ongoing support to the Marimaca team and development of the Project. The Company believes, on this basis, that equity financing of the MOD is achievable in combination with a broader capital raise from institutional and sophisticated investors.

Next Steps & Pre-Final Investment Decision Work Programs

Following the endorsement of the DFS by the Board of Marimaca, the Company will commence various early works activities which will include detailed design and engineering, grade control drilling, further optimization metallurgical programs, deposits on key equipment and acquisition of vendor engineer as well as site preparation works including construction of access roads and buildings. The DFS assumes these items are completed ahead of Final Investment Decision (ŌĆ£FIDŌĆØ) to achieve appropriate project maturity before FID.

Marimaca has cash on its balance sheet of over US$24m, which is sufficient to fund the commencement of these work items. The Company is dual listed on the Australian Stock Exchange (ŌĆ£ASXŌĆØ) and the Toronto Stock Exchange (ŌĆ£TSXŌĆØ), which provides it with access to a broad pool of specialist and generalist mining investors to further de-risk the eventual equity capital requirements for project development.

The Company is currently exploring strategic alternatives to the development of the Project, including engagement with strategic mining companies and copper producers, traders and offtakers, and other alternative financing sources.

Qualified/Competent Person

The independent Competent Persons (ŌĆ£CPŌĆØ), as defined under JORC, and Qualified Persons (ŌĆ£QPŌĆØ), as defined by NI 43-101 for this Press Release are defined below.

The statements in this Press Release relating to processing, costing, economics is Tommaso Roberto Raponi. Mr. Tommaso Roberto Raponi is a Professional Engineer registered with the Professional Engineers Ontario, Engineers and Geoscientists British Columbia, and NWT and Nunavut Association of Professional Engineers and Geoscientists. Mr. Raponi is a Principal Metallurgist with Ausenco Engineering Canada ULC, with an office address in Toronto, Ontario, Canada. Mr. Raponi is responsible for the processing, costing, economics aspects of the MOD DFS Report as a QP/CP. Mr. Raponi has sufficient experience relevant to the style of project consideration and to the activity he is undertaking to qualify as a Competent Person as such term is defined in the JORC Code (2012 edition) and a Qualified Person (as such term is defined in NI 43-101). The CP, Mr. Raponi, has read and verified the MOD DFS Press Release for matters related to processing, costing, economics based on the information he prepared for the DFS and in which they appear in the form and context.

The statements relating in this Press Release that relates to drilling, modelling and Mineral Resources estimation is based on and fairly represents information compiled by NCL Ingenier├Ła y Construcci├│n SpA. and reviewed by Luis Oviedo, P. Geo, an independent Consulting Geologist with more than 45 years of experience. Mr. Oviedo is a member of the Colegio de Geo╠ülogos and the Institute of Mining Engineers of Chile and takes responsibility for the Mineral Resource aspects of the MOD DFS Press Release as a CP. Mr. Oviedo has sufficient experience relevant to the style of mineralisation and type of deposit under consideration, and to the activity he is undertaking to qualify as a Competent Person as such term is defined in the JORC Code (2012 edition) and a Qualified Person (as such term is defined in NI 43-101). Mr. Oviedo has read and verified the MOD DFS Press Release for matters related to drilling, modelling and Mineral Resources based on the information he prepared for the DFS and in which they appear in the form and context. The Effective Date of the Mineral Resource Estimate is August 25, 2025

The statements relating in this Press Release that relates to Ore Reserves and the Mining section presented in the Appendix 1 is based on information prepared by and mine planning work by NCL Ingenier├Ła y Construcci├│n SpA. and reviewed by Carlos Guzm├Īn RM CMC, FAusIMM. Mr. Guzman is a mining engineer and Principal Director at NCL Ingenier├Ła y Construcci├│n SpA., a consulting firm based in Santiago, Chile. Mr. Guzman has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as a Competent Person as such term is defined in the JORC Code (2012 edition) and a Qualified Person (as such term is defined in NI 43-101). ). Mr. Oviedo has read and verified the MOD DFS Press Release for matters related to Ore Reserves and Mining based on the information he prepared for the DFS and in which they appear in the form and context. The Effective Date of the Mineral Reserve Estimate is August 25, 2025.

Mr. Scott C. Elfen is a Registered Civil Engineer in the State of California and in the State of Idaho. Mr. Elfen is the Global Lead of Geotechnical and Civil Services at Ausenco Engineering Canada ULC, with an office address in Vancouver, British Columbia, Canada. Mr. Elfen is responsible for the Process Plant Geotechnical information presented in the Appendix 1 of the MOD DFS Report as a CP. Mr. Elfen has sufficient experience relevant to the style of project consideration and to the activity he is undertaking to qualify as a Competent Person as such term is defined in the JORC Code (2012 edition) and a Qualified Person (as such term is defined in NI 43-101). The CP, Mr. Elfen, has read and verified the MOD DFS Press Release for matters related to Process Plant Geotechnical information based on the information he prepared for the DFS and in which they appear in the form and context.

Mr. James Millardis a professional geologist (P. Geo.) and member in good standing of the Association of Professional Geoscientists of Nova Scotia. Mr. Millard is a professional geologist and Director, Strategic Projects at Ausenco Sustainability ULC, with an office address in Dartmouth, Nova Scotia, Canada. Mr. Millard is responsible for the Environmental, Social and Community aspects presented in Appendix 1 of the MOD DFS Report as a CP. Mr. Millard has sufficient experience relevant to the activity he is undertaking to qualify as a Competent Person as such term is defined in the JORC Code (2012 edition) and a Qualified Person (as such term is defined in NI 43-101). Mr. Millard has read and verified the MOD DFS Press Release for matters related to Environmental, Social and Community aspects based on the information he prepared for the DFS and in which they appear in the form and context.

National Instrument 43-101

An independent technical report for the DFS prepared in accordance with NI 43-101 will be available under the Company 's SEDAR+ profile and website within 45 days of this announcement.

Contact Information

For further information, please visit www.marimaca.com or contact:

Tavistock

+44 (0) 207 920 3150

Emily Moss / Ruairi Millar

marimaca@tavistock.co.uk

Figures┬Āaccompanying this announcement┬Āare available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/76b6481a-610c-4511-8bd8-b060094b2619

https://www.globenewswire.com/NewsRoom/AttachmentNg/80a9a023-f440-4201-ad84-0a469d6b4b86

https://www.globenewswire.com/NewsRoom/AttachmentNg/1db98468-ba02-4813-a612-398a717d1f08

https://www.globenewswire.com/NewsRoom/AttachmentNg/09f56af7-b576-4dbc-9a4f-d1421c0a6c8b

© 2025 GlobeNewswire, Inc. All Rights Reserved.