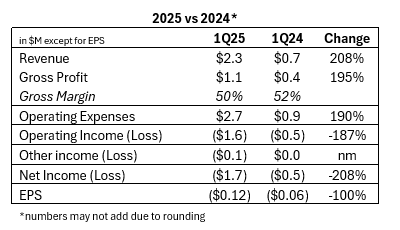

Laser Photonics Reports Strong Q1 2025 Revenue Growth Driven by Strategic CMS Integration and Multi-Sector Growth

Revenue Surges 208% Year-Over-Year to $2.3 Million as Company Capitalizes on Expanding Market Opportunities Across Defense, Medical and Industrial Sectors

Cost cutting initiatives to reduce run rate expenses by $2 million, gross, on an annualized basis

ORLANDO, FLORIDA / ACCESS Newswire / July 7, 2025 /Laser Photonics Corporation (NASDAQ:LASE), ( "Laser Photonics " or "the Company ") $LASE, a leading global developer of CleanTech laser systems for laser cleaning and other material applications, today announced results for its first quarter ended March 31, 2025.

Wayne Tupuola, CEO of Laser Photonics, commented:

"The first quarter demonstrated the potential of our strategic transformation, with revenue growth of over 200% year-over-year highlighting the success of our Control Micro Systems ( "CMS ") acquisition and multi-sector expansion strategy. Our expanded capabilities are resonating strongly with customers seeking advanced laser solutions. The fourth CleanTech system order from Acuren, second Navy order for our DefenseTech systems and multiple new CMS orders across dental, manufacturing and other precision applications validate our technology and support a growing market presence.

"We 're particularly excited about the medium- to long-term potential of our strategic partnerships, including the revolutionary laser-enabled robotic crawler demonstrated with Boston Engineering at Pearl Harbor Naval Shipyard. This breakthrough technology addresses the Navy 's $23 billion annual corrosion challenge and represents the type of innovative solutions that position Laser Photonics at the forefront of next-generation industrial applications. "

Carlos Sardinas, Chief Financial Officer of Laser Photonics, added:

"Our first quarter results reflect the successful progress we 've made to date on the integration of CMS and the revenue growth opportunities this acquisition has created. While, as a company, we 're in an investment phase to capture the significant market potential ahead of us, we remain focused on improving operational efficiency and the path to sustainable profitability. "

Business Highlights

DefenseTech: Building on strong Q4 2024 momentum, Laser Photonics secured additional orders from the U.S. Navy through distribution partner Incredible Supply & Logistics (ISL). The repeat order for the DefenseTech MRLS Portable Finishing Laser (DTMF-1020) handheld cleaning system validates the technology 's reliability and effectiveness for naval maintenance applications. Additionally, the Company 's strategic partnership with Boston Engineering showcased revolutionary laser-cleaning-enabled robotic crawlers at Pearl Harbor Naval Shipyard, demonstrating transformational potential for naval MRO processes.

CleanTech Industrial: Laser Photonics secured its fourth CleanTech system order from Acuren, a leading provider of asset protection services. The Company also received repeat orders from Bruce Power for additional CleanTech 500-CTHD laser cleaning systems for use at North America 's largest operational nuclear power plant, highlighting the safety and environmental advantages of laser cleaning technology in critical infrastructure applications.

Medical and Precision Manufacturing:CMS continued to demonstrate strong market traction with significant orders from a prominent global dental implant provider for robotic-feed dental drill bit marking systems and a leading U.S. high-performance bicycle manufacturer for advanced laser engraving systems. These wins highlight CMS 's technological prowess in precision applications and the strategic value of the acquisition in expanding Laser Photonics ' addressable markets.

2nd Quarter 2025 Outlook

Laser Photonics entered the second quarter of 2025, which ended June 30, 2025, with strong momentum and expects to report year-over-year revenue growth from the $0.7 million it reported in Q2 2024. The Company also took steps to reduce costs, mainly through headcount reductions and lower marketing spend, by a gross annualized run rate of $2 million.

About Laser Photonics Corporation

Laser Photonics is a vertically integrated manufacturer and R&D Center of Excellence for industrial laser technologies and systems. Laser Photonics seeks to disrupt the $46 billion, centuries-old sand and abrasives blasting markets, focusing on surface cleaning, rust removal, corrosion control, de-painting and other laser-based industrial applications. Laser Photonics ' new generation of leading-edge laser blasting technologies and equipment also addresses the numerous health, safety, environmental and regulatory issues associated with old methods. As a result, Laser Photonics quickly gained a reputation as an industry leader in industrial laser systems with a brand that stands for quality, technology and product innovation. Currently, world-renowned and Fortune 1000 manufacturers in the aviation, aerospace, automotive, defense, energy, maritime, nuclear and space-explorationindustries are using Laser Photonics ' "unique-to-industry " systems. For more information, visit https://www.laserphotonics.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains "forward-looking statements " (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended), including statements regarding the Company 's plans, prospects, potential results and use of proceeds. These statements are based on current expectations as of the date of this press release and involve a number of risks and uncertainties, which may cause results and uses of proceeds to differ materially from those indicated by these forward-looking statements. These risks include, without limitation, those described under the caption "Risk Factors " in the Registration Statement. Any reader of this press release is cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date of this press release except as required by applicable laws or regulations.

Laser Photonics Investor Relations Contact:

Brian Siegel, IRC, MBA

Senior Managing Director

Hayden IR

(346) 396-8696

laser@haydenir.com

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value data)

(unaudited)

As of March 31, 2025 (Unaudited) | As of December 31, 2024 (Audited) | |||||||

Assets | ||||||||

Current Assets: | ||||||||

Cash and Cash Equivalents | $ | 179,091 | $ | 533,871 | ||||

Accounts Receivable, Net | 904,155 | 973,605 | ||||||

Accounts Receivable | - | - | ||||||

Contract Assets | 639,108 | 759,658 | ||||||

Inventory | 2,001,760 | 2,338,759 | ||||||

Other Assets | 271,813 | 58,567 | ||||||

Total Current Assets | 3,995,927 | 4,664,460 | ||||||

Property, Plant, & Equipment, Net | 1,780,036 | 1,872,034 | ||||||

Intangible Assets, Net | 5,350,900 | 5,458,522 | ||||||

Other Long Term Assets | 316,378 | 316,378 | ||||||

Operating Lease Right-of-Use Asset | 4,592,058 | 4,840,753 | ||||||

Total Assets | $ | 16,035,299 | $ | 17,152,147 | ||||

Liabilities & Stockholders ' Equity | ||||||||

Current Liabilities: | ||||||||

Accounts Payable | $ | 1,211,407 | $ | 531,268 | ||||

Account payable related parties | 80,771 | 27,988 | ||||||

Short term loan | 825,000 | - | ||||||

Account payable | 27,988 | |||||||

Deferred Revenue | 470,493 | 55,383 | ||||||

Contract Liabilities | 1,337,963 | 1,042,090 | ||||||

Current Portion of Operating Lease | 472,882 | 649,989 | ||||||

Accrued Expenses | 474,189 | 266,717 | ||||||

Total Current Liabilities | 4,872,705 | 2,573,435 | ||||||

Long Term Liabilities: | ||||||||

Lease liability - less current | 4,314,889 | 4,366,419 | ||||||

Total Long Term Liabilities | 4,314,889 | 4,366,419 | ||||||

Total Liabilities | 9,187,594 | 6,939,854 | ||||||

Stockholders ' Equity: | ||||||||

Preferred stock Par value $0.001: 10,000,000 shares authorized. 0 Issued: 0 shares were outstanding as of March 31, 2025 and December 31, 2024 | - | - | ||||||

Common Stock Par Value $0.001: 100,000,000 shares authorized; 14,301,087 issued and 14,276,150 outstanding as of March 31, 2025 and 14,282,395 issued and 14,257,458 outstanding as of December 31, 2024 | 14,276 | 14,257 | ||||||

Additional Paid in Capital | 16,302,275 | 17,886,159 | ||||||

Retained Earnings (Deficit) | (9,435,036 | ) | (7,754,313 | ) | ||||

Shares to be issued | - | 100,000 | ||||||

Treasury Stock | (33,810 | ) | (33,810 | ) | ||||

Total Stockholders ' Equity | 6,847,705 | 10,212,293 | ||||||

Total Liabilities & Stockholders ' Equity | $ | 16,035,299 | $ | 17,152,147 | ||||

STATEMENTS OF PROFIT AND LOSS

(in thousands, except per share data)

(unaudited)

March 31, 2025 | March 31, 2024 | |||||||

Net Sales | $ | 2,290,282 | $ | 742,991 | ||||

Cost of Sales | 1,150,516 | 357,123 | ||||||

Gross Profit | 1,139,766 | 385,868 | ||||||

Operating Expenses: | ||||||||

Sales & Marketing | 617,699 | 136,610 | ||||||

General & Administrative | 900,034 | 356,265 | ||||||

Depreciation & Amortization | 237,011 | 185,316 | ||||||

Payroll Expenses | 840,861 | 208,455 | ||||||

Research and Development Cost | 116,686 | 47,691 | ||||||

Total Operating Expenses | 2,712,291 | 934,337 | ||||||

Operating Income (Loss) | (1,572,525 | ) | (548,469 | ) | ||||

Other Income (Expenses): | ||||||||

Other Income | 1,451 | 30 | ||||||

Other Expenses | (109,649 | ) | 2,730 | |||||

Total Other Income (Loss) | (108,198 | ) | 2,760 | |||||

Income (Loss) Before Tax | (1,680,723 | ) | (545,709 | ) | ||||

Tax Provision | - | - | ||||||

Net Income (Loss) | $ | (1,680,723 | ) | $ | (545,709 | ) | ||

Loss per Share: | ||||||||

Basic | $ | (0.12 | ) | $ | (0.06 | ) | ||

Fully diluted | $ | (0.12 | ) | $ | (0.06 | ) | ||

WASO | 14,271,581 | 9,234,650 | ||||||

Statement of Cash Flows

(in thousands)

(unaudited)

Quarter Ended March 31 | ||||||||

2025 | 2024 | |||||||

OPERATING ACTIVITIES | ||||||||

Net Loss/Gain | $ | (1,680,723 | ) | (545,709 | ) | |||

Adjustments to Reconcile Net Loss to Net Cash Flow from Operating Activities: | ||||||||

Bad Debt | 10,651 | - | ||||||

Shares issued for compensation | 33,336 | |||||||

Distribution to affiliate | (1,683,865 | ) | (1,019,687 | ) | ||||

Impairment | - | |||||||

Depreciation & Amortization | 237,011 | 185,316 | ||||||

Net Change, Right-of-Use Asset & Liabilities | 20,059 | - | ||||||

Change in Operating Assets & Liabilities: | ||||||||

Accounts Receivable | 58,800 | 373,055 | ||||||

Contract Assets | 120,550 | - | ||||||

Inventory | 322,167 | 110,816 | ||||||

Prepaids & Other Current Assets | (213,247 | ) | (75,565 | ) | ||||

Accounts Payable | 732,922 | 83,261 | ||||||

Contract Liabilities | 295,873 | |||||||

Accrued Expenses | 207,475 | (82,531 | ) | |||||

Deferred Revenue | 415,107 | 71,452 | ||||||

Net Cash Used in Operating Activities | (1,157,220 | ) | (866,256 | ) | ||||

INVESTING ACTIVITIES | ||||||||

Purchase of Property, Plant an Equipment | (22,560 | ) | (161,755 | ) | ||||

Net Cash Used in Investing Activities | (22,560 | ) | (161,755 | ) | ||||

FINANCING ACTIVITIES | ||||||||

Borrowings on debt | 825,000 | - | ||||||

Net Cash provided by (used in) Financing Activities | 825,000 | - | ||||||

Net Cash Flow for Period | (354,780 | ) | (1,028,011 | ) | ||||

Cash and Cash Equivalents - Beginning of Period | 533,871 | 6,201,137 | ||||||

Cash and Cash Equivalents- End of Period | $ | 179,091 | 5,173,126 | |||||

NON-CASH INVESTING AND FINANCING ACTIVITIES | ||||||||

Shares issued for Investment | 100,000 | - | ||||||

Transfer demo inventory to PPE | 14,833 | - | ||||||

SUPPLEMENTARY CASH FLOW INFORMATION | - | |||||||

Cash Received / Paid During the Period for: | - | |||||||

Income Taxes | - | - | ||||||

Interest | - | - | ||||||

SOURCE:Laser Photonics Corp.

View the original press release on ACCESS Newswire

© 2025 ACCESS Newswire. All Rights Reserved.